ECB Poised for Rate Cuts Ahead of Peers

The European Central Bank (ECB) has clearly indicated its intention to lower interest rates from their historic highs next week, with its chief economist dismissing concerns about potential repercussions compared to the US Federal Reserve.

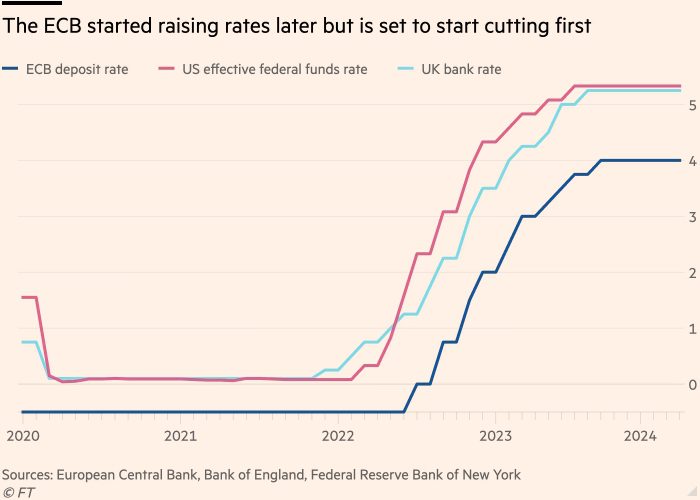

The ECB appears poised to be among the first major central banks to implement rate cuts, following criticism for being among the last to raise rates amidst the largest inflation surge in a generation three years ago.

Philip Lane, in an interview with the Financial Times preceding the bank’s pivotal June 6 meeting, stated: “Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.”

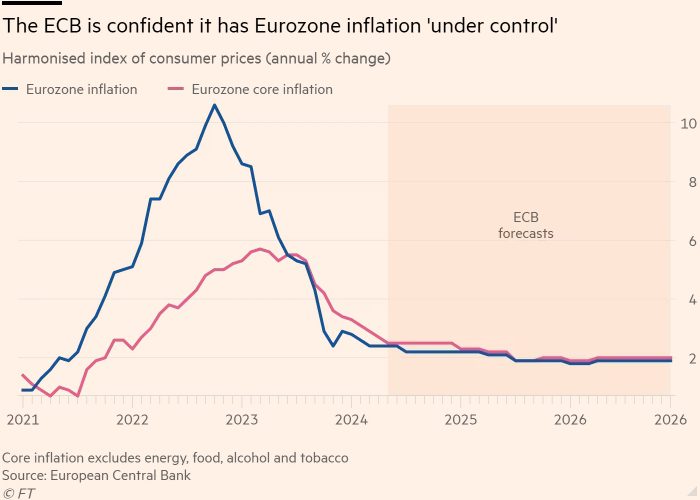

Market investors are heavily speculating that the ECB will decrease its benchmark deposit rate by a quarter percentage point from its record high of 4 per cent at the upcoming meeting, following Eurozone inflation’s proximity to the bank’s 2 per cent target.

This year, central banks in Switzerland, Sweden, Czech Republic, and Hungary have responded to declining inflation by reducing borrowing costs. However, among major economies, the Fed and Bank of England are not anticipated to cut rates before summer, while the Bank of Japan is more likely to continue raising rates.

When questioned about his sentiments regarding the ECB’s potential to cut rates ahead of others, Lane remarked: “Central bankers aspire to be as boring as possible and I would hope central bankers aspire to have as little ego as possible.”

Eurozone Inflation Trends and ECB Monetary Policy Strategy

He emphasized that a significant factor contributing to the faster decline in inflation within the Eurozone compared to the US was the region’s greater exposure to the energy shock resulting from Russia’s invasion of Ukraine. “Addressing the challenges posed by the war and the energy crisis has incurred considerable costs for Europe,” he remarked.

“Nevertheless, initiating the process of rate cuts signifies the effectiveness of monetary policy in ensuring timely reduction of inflation. In this regard, I believe we have achieved success.”

Lane underscored the necessity for ECB policymakers to maintain interest rates at restrictive levels throughout the year to facilitate continued easing of inflation, thereby preventing it from persisting above the bank’s target, which he cautioned would be highly problematic and likely difficult to rectify.

However, he indicated that the pace at which the central bank would lower borrowing costs in the Eurozone this year would be determined by a careful assessment of data to ascertain whether such actions are proportionate, safe, and within the confines of the restrictive zone.

Eurozone Monetary Policy Outlook and Exchange Rate Dynamics

“Expect some turbulence and a gradual trajectory,” Lane remarked, responsible for formulating and presenting the proposed rate decision to the 26 members of the governing council next week.

“This year, the consensus is to maintain a restrictive stance throughout, but with room for some downward adjustment within the restrictive range,” he added.

Lane explained in a speech on Monday, “The pace of subsequent rate cuts will be moderated in case of unexpected upward trends in underlying inflation and demand, but accelerated in the event of downward surprises.” He clarified to reporters at the Dublin event, “The discussion about a rate cut next week shouldn’t be viewed as a declaration of victory.”

Despite recent data indicating a near-record acceleration in Eurozone wage growth at the beginning of the year, Lane noted, “Overall, the trajectory of wages still indicates a slowdown, which is crucial,” supported by the ECB’s wage tracker.

Some analysts cautioned that a more aggressive rate cut by the ECB compared to the Fed could depreciate the euro and boost inflation by increasing import prices into the bloc.

Lane stated the ECB would consider any “significant” exchange rate movements but highlighted the lack of substantial shifts. The euro has rebounded by a fifth against the US dollar from a six-month low in April and remains higher over the past year.

Instead, Lane pointed out that delays in expected Fed rate cuts had elevated US bond yields, subsequently raising long-term yields of European bonds.

“This mechanism implies that for any set interest rate, there’s additional tightening from US conditions,” he explained, suggesting the ECB might need to counterbalance this with additional cuts to its short-term deposit rate. “All things being equal, if the long end tightens more, it alters our perspective on the short end.”

Eurozone Inflation Trends and ECB Policy Outlook

Eurozone inflation, which peaked above 10 percent in 2022, has descended to a near three-year low of 2.4 percent in April. However, it is anticipated to edge up to 2.5 percent with the release of May’s data this week.

Lane noted that the persistent upward pressure on services prices due to rapid wage growth necessitates the ECB to maintain a restrictive policy stance until 2025.

“Next year, as inflation visibly approaches the target, the discussion will shift towards ensuring that the interest rate aligns with that target—a different debate altogether,” he remarked.

The extent of rate cuts by the ECB will depend on its evaluation of the neutral rate, which signifies the equilibrium point where savings and investment are balanced, and output matches an economy’s potential while inflation aligns with the target.

Estimates of the neutral rate vary, but Lane suggested it would likely imply a policy rate at or slightly above 2 percent. However, he noted the possibility of a higher neutral rate if significant factors such as a robust green transition to renewable energy or substantial gains from generative artificial intelligence drive increased investment.

(Additional reporting by Jude Webber in Dublin)