SUMMARY

ASIC miners (Application-Specific Integrated Circuits) are specialized hardware designed for specific mining algorithms, offering substantial benefits for miners, including long-term investment potential, superior hashrates, and high stability. For LKY mining, ASIC miners, such as the Antminer L9

Why Choose ASIC Miners for LKY Mining?

Long-Term Investment

ASIC miners are optimized for specific mining algorithms, offering high performance and low power consumption, making them ideal for long-term investment in the mining industry.

Superior Hashrate

ASIC miners have much higher hash rates compared to GPUs and CPUs, enabling faster block calculations. This advantage is especially crucial in a constantly increasing network hashrate environment.

Stability and Reliability

Due to their specialized design, ASIC miners tend to be more stable and reliable, capable of running efficiently over long periods and minimizing downtime and hardware failures.

Key Parameters to Consider When Choosing ASIC Miners

Hashrate

Hashrate is a critical performance metric for miners, measured in Hash/s (hashes per second). As the overall network hashrate continues to rise, mining difficulty increases, and only miners with high hashrates will remain profitable.

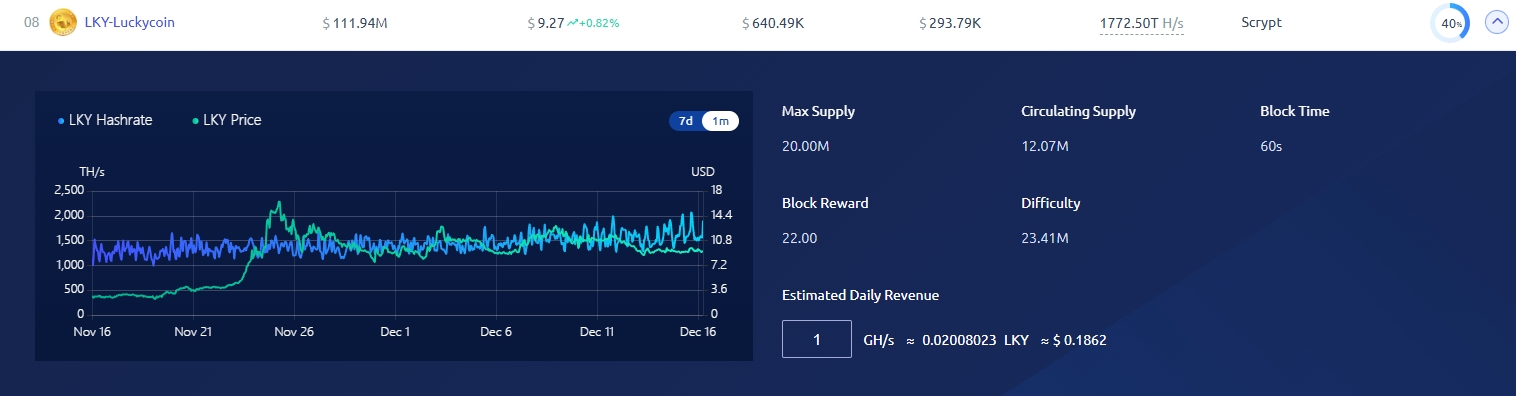

- Current LKY Network Hashrate: 2014.61 TH/s

- Mining Difficulty: 34.11 M

High-hashrate miners are essential to cope with the current mining environment.

Power Consumption

Power consumption directly affects mining costs. When choosing an ASIC miner, consider:

- Whether you have enough electrical resources to support high-power miners.

- Whether electricity prices are low enough, as electricity cost is a significant part of mining expenses.

For example, regions where electricity costs less than $0.05 per kWh are more suitable for ASIC miners, as higher electricity prices could erode profitability and extend the payback period.

Cooling Performance

Due to continuous high-intensity operation, good cooling performance is vital. Many ASIC miners use air-cooling systems, but ambient temperature can still impact performance:

- In hot climates, miners may overheat and stop working, causing losses in mining revenue.

- If operating in high-temperature environments, additional cooling systems (like air conditioning) may be needed to maintain stable performance.

Why Choose a Mining Pool?

More Stable Earnings

Mining pools aggregate the hash power of many miners to work together on solving blocks. Rewards are then distributed proportionally based on each miner’s contribution, reducing the income fluctuations associated with block reward randomness.

Lower Mining Difficulty

Solo mining can be highly difficult, but mining pools divide the workload, lowering the barrier to entry for individual miners.

Convenient Management

Mining pools usually provide comprehensive monitoring and management tools, allowing miners to easily track their earnings and equipment status.

Mining Pools Supporting LKY Pool Mining

Here are some of the major mining pools that support Luckycoin (LKY) pool mining:

- ViaBTC: Low fees, supports LTC merged mining, uses PPLNS (Pay Per Last N Shares) payout system.

- f2pool: High hash power coverage, supports multi-coin mining, transparent earnings distribution.

- Binance Pool: Comprehensive management tools, suitable for medium to large miners, pays using PPLNS.

These pools offer stable reward distribution, especially useful in an environment where the overall network hashrate is high.

Differences Between Pool Mining and Solo Mining

Pool Mining

Advantages: Lower difficulty, more stable earnings; ideal for miners with lower hash power. Disadvantages: Pool fees and rewards are split according to pool rules.

Solo Mining

Advantages: No pool fees; miners keep 100% of the block rewards. Disadvantages: High hash power requirements, unstable earnings, and long periods without rewards.

Recommended Miners & Purchasing Guide

1.Why Choose Antminer L9

- 16Gh/s Version: Suitable for miners with a lower budget but still looking for high hash power.

- 17Gh/s Version: Suitable for miners looking for even higher returns and greater power.

2.Profitability

- Price: The 16Gh/s version is priced around $14,700, while the 17Gh/s version is priced around $15,700.

- Daily Earnings

Asic Miners Daily profit and price list

3.Payback Period

The payback period for the L9 miner is estimated to be around 250-300 days, depending on electricity costs, coin prices, and mining difficulty. By diversifying mining rewards through merged mining, the L9 miner allows miners to reduce reliance on a single cryptocurrency, mitigating risks and enhancing profitability. L9 also supports merged mining, allowing you to mine multiple coins like LTC, DOGE, BELLS, LKY, PEPE, and JKC simultaneously, which diversifies your income sources ASIC miners, particularly the L9 model, represent an ideal solution for LKY mining due to their high performance and energy efficiency. While solo mining offers higher rewards without pool fees, mining in a pool is a safer choice for most miners, ensuring more stable returns. It’s important for miners to assess power costs, hashrate, and cooling needs before investing in an ASIC miner. Additionally, merged mining can further enhance profitability by diversifying the mining rewards. For miners with the right resources, ASIC mining offers a solid return on investment with a predictable payback period, making it a strong choice for those serious about LKY mining.