SUMMARY

In Equihash mining, the Antminer Z15 and Z15 Pro remain two of the most commonly compared ASIC miners. If your infrastructure supports higher power demands, Antminer Z15 Pro is generally seen as a more stable long-term option. However, for miners with tight budgets and higher electricity costs, Antminer Z15 may deliver a more attractive payback period. This guide compares Z15 vs Z15 Pro across performance, coins, profitability, setup, and use cases.

What Are Antminer Z15 and Z15 Pro?

Both Bitmain Antminer Z15 and Bitmain Antminer Z15 Pro are Equihash ASIC miners designed by Bitmain for privacy-focused cryptocurrencies such as ZEC (Zcash) and ZEN (Horizen).

Z15: Standard Equihash miner with balanced hashrate and power consumption

Z15 Pro: Upgraded version with significantly higher hashrate and improved efficiency, targeting professional or large-scale operations

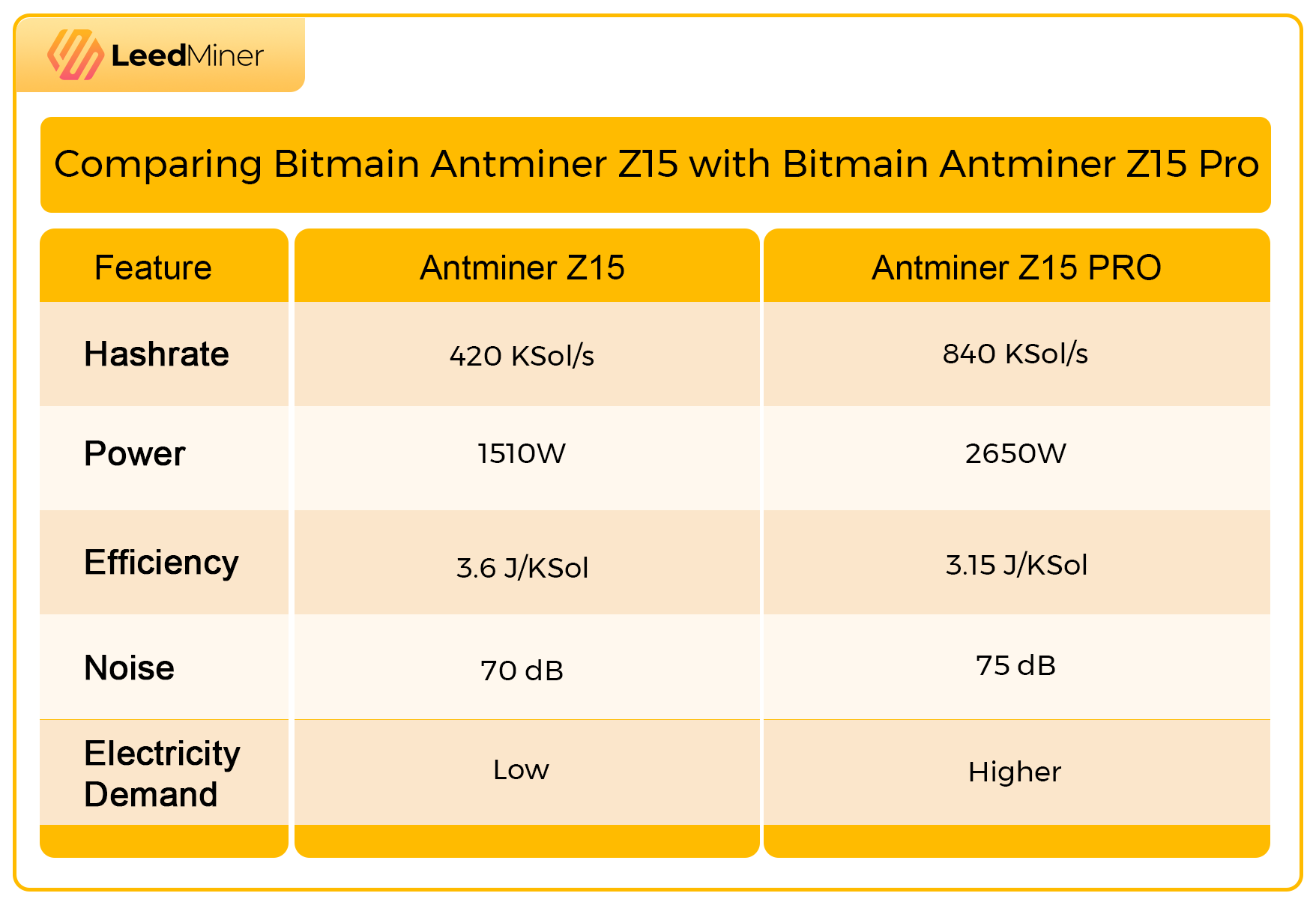

Core Specifications Comparison

While both miners use the same Equihash algorithm, they differ significantly in hashrate, power consumption, and energy efficiency. The Z15 Pro (840 KSol/s) is an upgraded version of the Z15 (420 KSol/s), offering higher hashrate and improved energy efficiency, while also drawing more power overall.

ZEC vs ZEN: How Coin Choice Affects Your Decision?

In fact, both ZEC and ZEN coins can be mined efficiently on the Z15 or Z15 Pro. In practice, coin choice alone rarely determines results; hashrate, power cost, and operating conditions usually play a larger role.

Mining Zcash (ZEC): Z15 vs Z15 Pro

- ZEC offers deep liquidity and a mature market, reducing exposure to price volatility

- A stable network and long-established mining ecosystem favor consistent returns

- The Z15’s hashrate and power consumption are well balanced for steady Equihash mining

- Lower overall power requirements make cost control easier

- Well suited for miners prioritizing predictability and long-term stability

Mining Horizen (ZEN): Z15 vs Z15 Pro

- ZEN uses the same Equihash algorithm, ensuring full hardware compatibility

- Network dynamics can reward higher hashrate during favorable difficulty periods

- The Z15 Pro’s higher performance density allows it to capture upside more effectively

- Better suited for operations that can handle higher power draw and cooling demands

- Appeals to miners actively managing diversification and risk

Antminer Z15 vs Z15 Pro: What Are the Key Decision Factors?

Hashrate and Performance

The Antminer Z15 Pro delivers nearly double the hashrate of the Z15 miner, which results in:

- Higher theoretical daily output

- Stronger resistance to increasing network difficulty

That said, higher hashrate does not guarantee proportional profit increases, as difficulty and market price fluctuate continuously.

Power Efficiency and Electricity Cost

Z15: Lower total power draw, easier to manage operating expenses

Z15 Pro: Better efficiency per KSol, but significantly higher absolute electricity usage

In regions with electricity costs above average, the Z15 often provides a more predictable cost structure.

With low-cost power or hosting services, the Z15 Pro’s efficiency advantage becomes more relevant.

Noise and Environmental Requirements

Z15: More suitable for small-scale or semi-isolated environments

Z15 Pro: Best deployed in dedicated mining farms or professional hosting facilities

Noise tolerance and ventilation capacity should be evaluated before choosing either model.

Availability and Operating Conditions

From a practical sourcing perspective:

- Z15 units are often easier to find on the secondary market

- Z15 Pro availability may vary more by batch, condition, and hosting compatibility

2026 Profitability & ROI Analysis

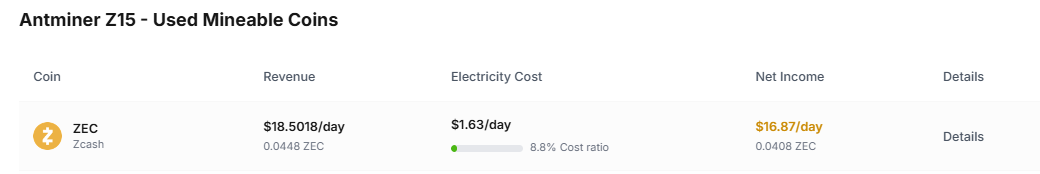

Evaluating the return on investment (ROI) and overall profitability of the Antminer Z15/Z15 Pro is essential to determining its worth as a purchase. At an electricity rate of $0.045 per kWh, its current daily profitability is as follows:

Profitability

Calculation formula: Daily net profit = Daily Revenue – Daily electricity cost

Z15 420K : $16.87 = $18.5018 – $1.63

Z15 Pro 840K : $29.57 = $32.5772 – $3

ROI, Return on Investment

Calculation formula: Static ROI Period = Total Hardware Cost / Daily Net Revenue

Z15 420K : 173 days = ( $3089+$1.63 ) /$17.83

Z15 Pro 840K : 127 days = ( $4549+$3 ) /$35.93

This comparison highlights how Z15 profitability and Z15 Pro profitability diverge under the same power rate assumptions.

You can check the real-time comparison results at ASIC Miner Comparison .

Advantages of the Z15 Pro

- Higher output potential during favorable market cycles

- Better suited for continuous, long-term operation under low electricity costs

When conditions are optimal, Z15 Pro shortens the payback cycle.

Opportunities with the Z15

- Lower entry cost

- Reduced financial exposure during market downturns

When evaluating Bitmain Antminer Z15 profitability in 2026, mining costs remain the single most influential variable. For many miners, slower but steadier recovery is preferable to faster but fragile returns.

Which Type of User Should Choose Each Model?

Choose the Z15 if you:

- You mine at home or in a mixed-use space

- Operate under higher electricity rates

- Are entering Equihash mining for the first time

- Prefer cost control and operational flexibility

Choose the Z15 Pro if you:

- You operate in a controlled mining environment

- Have access to low-cost electricity or hosting

- Already operate at scale

- Focus on performance density and efficiency

Conclusion

If your priority is stability, predictable costs, and lower operational risk, the Z15 miner is often the more practical and forgiving choice.

If you benefit from low electricity costs and professional infrastructure, the Z15 Pro miner offers stronger long-term efficiency potential.

Ultimately, the best miner is not defined by specifications alone—but by how well it aligns with your real-world constraints.