SUMMARY

The Bitmain Antminer S21e Hyd, released in April 2025, is a cutting-edge water-cooled Bitcoin miner that delivers 288 TH/s of hashrate at an efficiency of 17.0 J/TH. Designed for high-performance and long-term stability, it features advanced liquid cooling that ensures low noise, effective heat management, and consistent operation in demanding environments—making it a top choice for professional mining operations. In this review, we take a deep dive into the S21e Hyd’s technical specifications, performance comparisons, profitability analysis, and its long-term value for mining farm operators. Whether you’re considering a single unit or large-scale deployment, this guide will help you understand why the S21e Hyd stands out in today’s competitive mining landscape.

Technical Specifications

| Manufacturer | Bitmain |

|---|---|

| Model | Antminer S21e Hyd (288Th) |

| Also known as | Bitmain Antminer S21e Hyd |

| Release | Apr 2025 |

| Size | 410 x 170 x 209mm |

| Noise level | 50dB |

| Power | 4896W |

| Interface | Ethernet |

| Temperature | 5 – 45 °C |

| Humidity | 5 – 95 % |

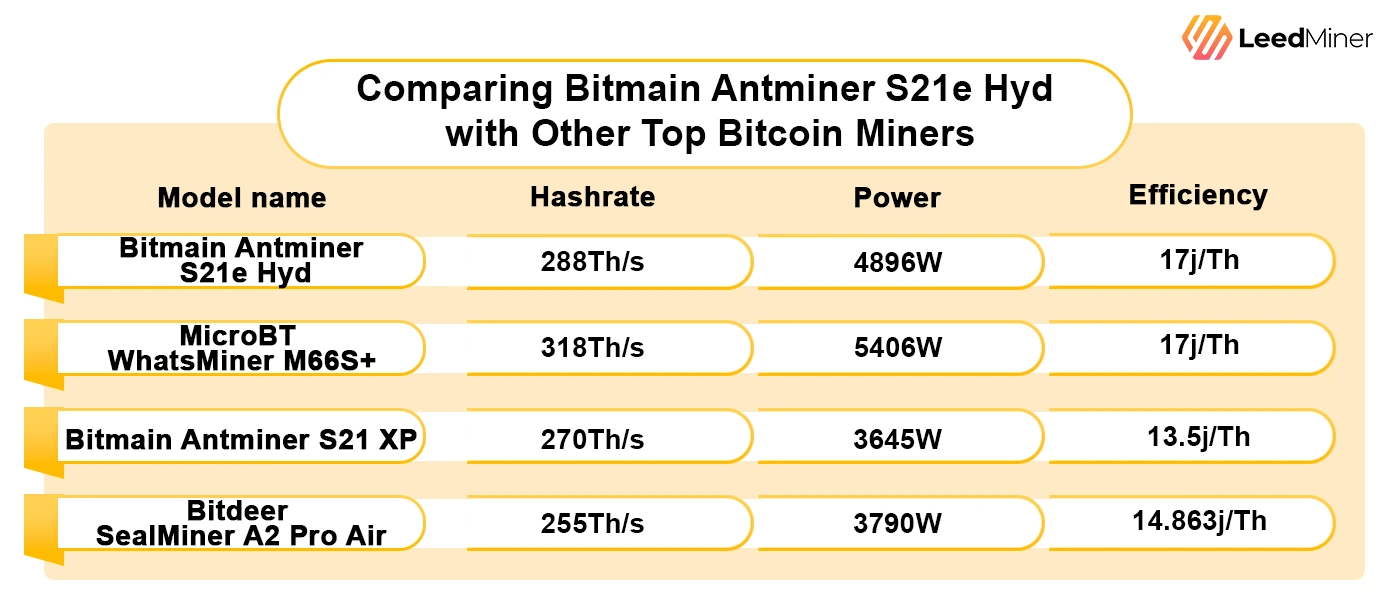

Comparing Bitmain Antminer S21e Hyd with Other Top Bitcoin Miners

The cryptocurrency mining landscape continues to evolve with increasingly powerful and efficient hardware options. Among these, the Bitmain Antminer S21e Hyd

Key Specifications Comparison

Performance Analysis

When examining the performance metrics across these top-tier mining machines, several distinct advantages of the Antminer S21e Hyd become apparent. The S21e Hyd delivers a hashrate of 288 TH/s, positioning it significantly above the S21 XP MicroBT WhatsMiners M66S+

Cooling Technology Advantages

The water-cooling system of the S21e Hyd provides substantial benefits over traditional air-cooled units:

- Temperature Management: Water cooling enables more efficient heat dissipation, maintaining optimal operating temperatures even under heavy loads or in warmer environments.

- Operational Stability: The consistent cooling leads to more stable hashrates with less throttling during extended mining sessions.

- Noise Reduction: Water-cooled systems typically operate at significantly lower noise levels than their air-cooled counterparts, making them suitable for a wider range of installation environments.

- Scalability Benefits: In large mining operations, water cooling can simplify heat management at scale and potentially reduce overall cooling costs.

Release Timing and Technological Edge

As the newest model in this comparison with an April 2025 release date, the S21e Hyd likely incorporates the latest advancements in ASIC design and manufacturing processes. This timing advantage potentially gives it better longevity as the mining difficulty continues to increase, extending its viable operational lifespan compared to older models.

Why Choose Bitmain Antminer S21e Hyd

The Bitmain Antminer S21e Hyd represents an optimal choice for serious mining operations for several compelling reasons:

- Future-Proof Technology: With its April 2025 release, it incorporates the latest advancements in mining technology, ensuring relevance as difficulty increases.

- Performance Balance: The 288 TH/s hashrate strikes an excellent balance between raw power and reasonable efficiency.

- Infrastructure Integration: For operations already invested in water cooling infrastructure, the S21e Hyd seamlessly integrates while delivering superior performance.

- Environmental Adaptability: The water cooling system makes it suitable for deployment in various climates and environments where air-cooled units might struggle.

- Noise Management: Significantly quieter operation enables deployment in a wider range of locations, including those with noise restrictions.

- Operational Resilience: The superior thermal management translates to more consistent performance and potentially fewer maintenance issues over time.

When considering the total cost of ownership, operational stability, and long-term mining profitability, the Bitmain Antminer S21e Hyd presents a compelling value proposition for professional mining operations looking to maximize their competitive edge in the increasingly challenging Bitcoin mining ecosystem.

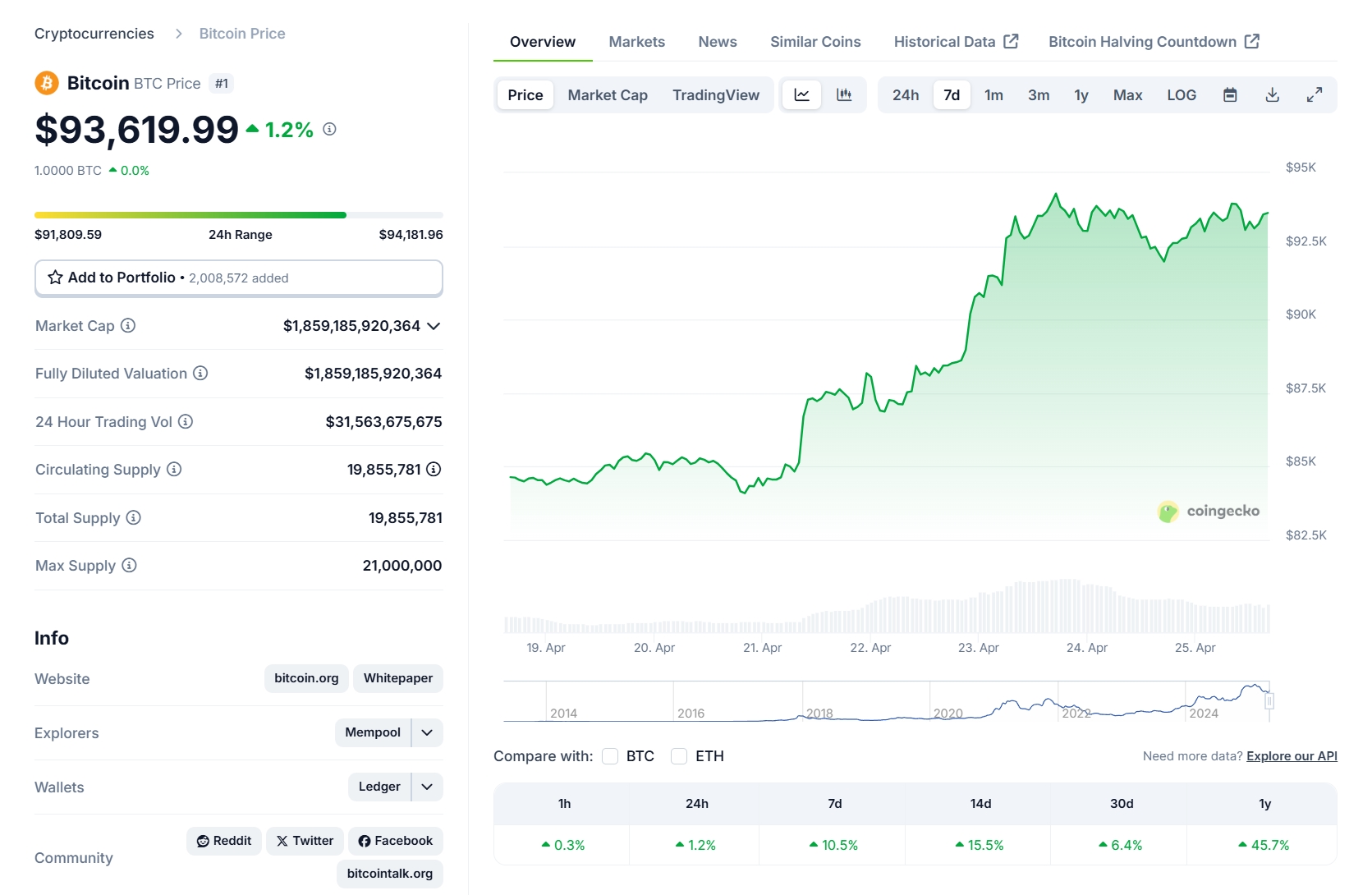

Bitcoin Prices History

Let’s take a look at the current market status of Bitcoin(BTC)

Bitcoin Market Snapshot (As of April 25, 2025)

| Metric | Value |

|---|---|

| Current Price | $93,619.99 |

| All-Time High (ATH) / Low (ATL) | $108,786 / $67.81 |

| Market Capitalization | $1,859,185,920,364 |

| Fully Diluted Valuation (FDV) | $1,859,185,920,364 |

| Market Rank | #1 |

| Circulating Supply | 19,855,781 |

Bitcoin Price Trend

Bitcoin (BTC) continues to hold its position as the top cryptocurrency by market capitalization, currently valued at $1.86 trillion. Over the past 24 hours, BTC recorded a trading volume of $31.56 billion, representing a 14% drop, signaling a slight dip in short-term market activity. Price-wise, Bitcoin is currently trading 13.93% below its all-time high of $108,786, but still an astonishing 137,984.88% above its all-time low of $67.81—a testament to its long-term growth and adoption. With 20 million BTC currently in circulation and a capped supply of 21 million, Bitcoin’s fully diluted valuation matches its current market cap, indicating that nearly all of its supply is already active on the market. In the past 7 days, BTC has posted a 10.5% gain, slightly outperforming the global crypto market average of 10.4%—showcasing strong investor confidence amid broader market recovery. 📌 All data as of April 25, 2025. For real-time updates, please refer to CoinGecko or other reliable sources.

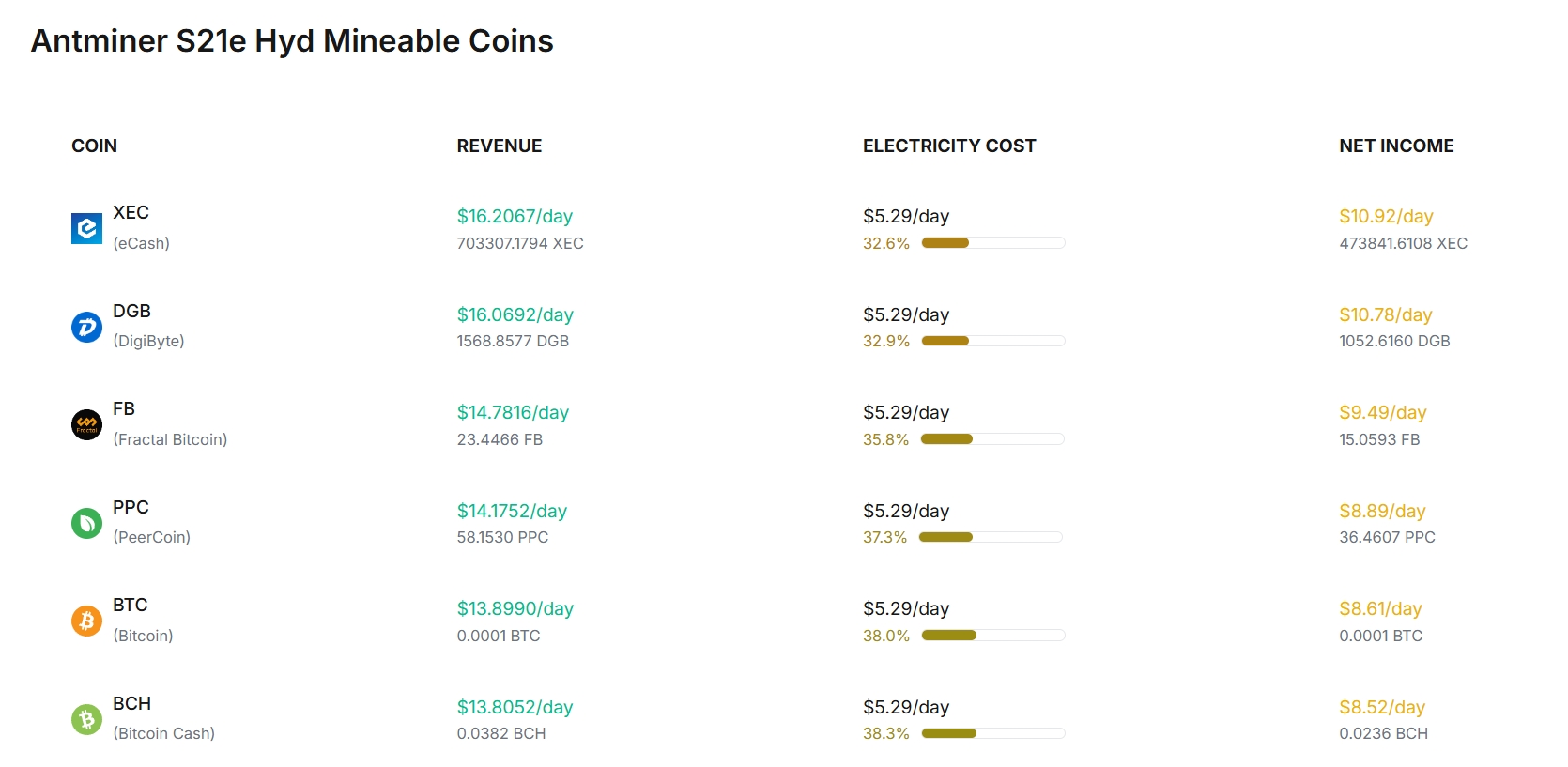

Bitmain Antminer S21e Hyd Profitability

Based on an electricity cost of $0.045 per kWh, here’s the estimated daily profitability for the Bitmain Antminer S21e Hyd:

- Daily Mining Income: $13.90

- Daily Electricity Cost: $5.29

- Electricity Cost Ratio: 38.0% of daily income

- Net Daily Profit: $8.61

With approximately 62% of revenue retained as net profit, the Antminer S21e Hyd presents a compelling option for miners operating in regions with access to competitive electricity rates. This favorable profit ratio makes it an attractive choice for both established mining farms and newcomers to the industry.

Mining Farm Operator Perspective

For mining farm operators considering the S21e Hyd, the profitability analysis extends beyond pool-based average earnings. Large-scale mining operations often aim to establish independent mining capabilities to capture full block rewards rather than relying solely on mining pools. When evaluating the S21e Hyd for direct mining operations, mining farm operators should consider:

- Block Reward Potential: The current block reward of 3.125 BTC (approximately $290,625 ) represents significant upside compared to pooled mining distributions

- Hashrate Contribution: Each S21e Hyd contributes 288 TH/s toward the probability of solving blocks

- Scale Requirements: To reliably capture block rewards independently, operators typically need substantial hashrate deployment

- Variance Management: Independent mining introduces reward variance that must be balanced against consistent pool payouts

For a mining farm deploying multiple S21e Hyd units at scale, the expected value calculation shifts from daily pool distributions to probability-based block rewards. A farm with sufficient scale might achieve more favorable economics through independent mining, especially when factoring in pool fees avoidance.

Future Perspective of Bitmain Antminer S21e Hyd

Competitive Edge in a Mixed Cooling Market

The Bitcoin mining hardware landscape features a diverse array of both air-cooled and water-cooled options competing for market share. Among these, the Bitmain Antminer S21e Hyd stands out distinctively with its water-cooling technology. While competitors offer various cooling solutions, the S21e Hyd’s advanced water cooling system provides a significant competitive advantage, particularly in large-scale mining operations where thermal management is critical to maintaining consistent performance and hardware longevity.

Superior Performance Stability in Challenging Environments

Where air-cooled competitors struggle with performance throttling in high-temperature environments, the S21e Hyd maintains optimal operating conditions through its efficient water cooling system. This translates to more consistent hashrate delivery regardless of ambient conditions—a crucial advantage for mining operations in regions with variable or warm climates. The stable thermal environment also enables the S21e Hyd to maintain its advertised 288 TH/s performance more reliably over extended mining periods compared to air-cooled alternatives that may experience significant performance fluctuations.

Long-Term Economic Advantages

Despite a potentially higher initial investment, the S21e Hyd offers compelling long-term economic benefits that outweigh many air-cooled alternatives. The superior cooling efficiency results in more consistent operation at optimal parameters, extending the effective lifespan of the mining hardware beyond what typical air-cooled systems can achieve. For professional mining operations calculating total cost of ownership over multi-year periods, the S21e Hyd’s enhanced durability, consistent performance, and efficient heat management present a more favorable long-term value proposition, particularly as Bitcoin mining continues to professionalize and operators focus increasingly on infrastructure optimization rather than just hardware specifications.