SUMMARY

In the world of cryptocurrency, there’s an old saying: “Not your keys, not your coins.” crypto wallet

That’s why choosing the right wallet is one of the most important decisions for anyone involved in crypto—especially miners.

merged mining

What Is a Crypto Wallet and Why It Matters

A crypto wallet is a tool—software or hardware—that stores your private keys. These keys allow you to access, send, and receive cryptocurrencies. Unlike a bank account, your wallet doesn’t actually “store” the coins. The coins exist on the blockchain; your wallet holds the credentials to access them. For miners, your wallet is where the mining pool sends your rewards. If you’re doing dual mining (like mining Litecoin and receiving Dogecoin as a merged bonus), you’ll need to provide a valid wallet for each coin to receive both payouts. Without proper wallet configuration, you may mine for hours or days—and receive nothing.

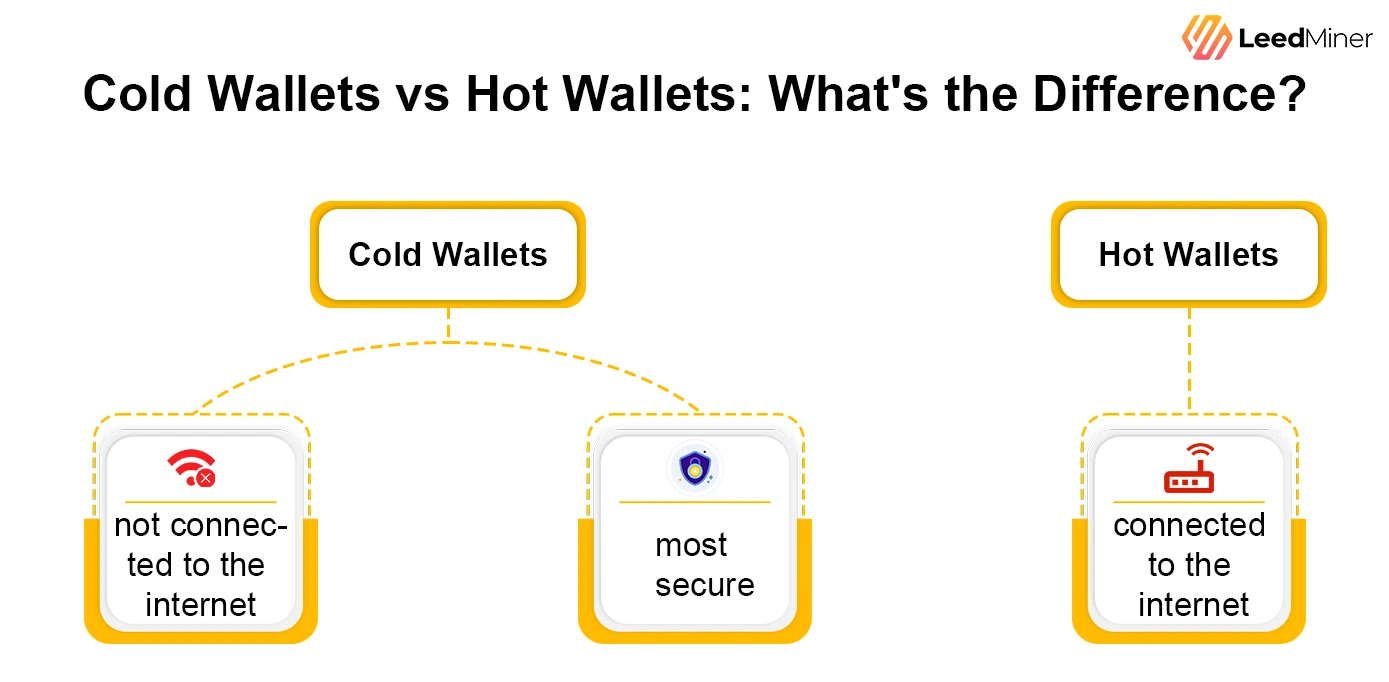

Cold Wallets vs Hot Wallets : What’s the Difference

There are two main categories of wallets

Cold Wallets

Wallets that are not connected to the internet. These are considered the most secure.

Hot Wallets

Wallets that are connected to the internet, making them easier to use—but more vulnerable to hacks.

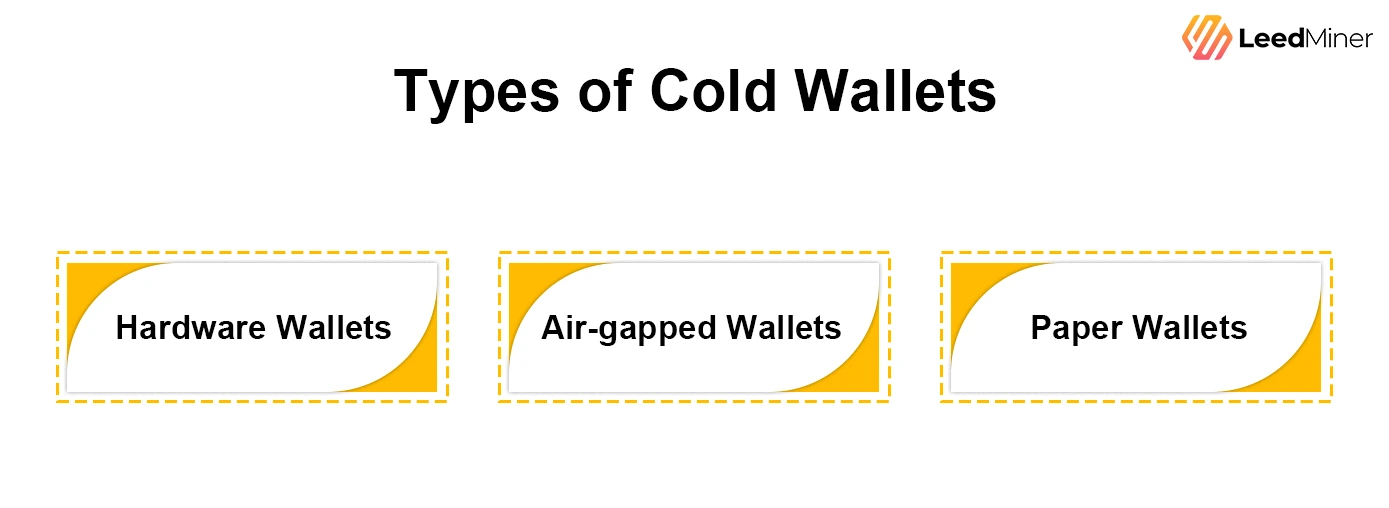

Types of Cold Wallets

• Hardware Wallets

Devices like Ledger and Trezor. These are physical USB-style wallets that store your private keys offline.Ideal for long-term storage and mining HODLers.

• Air-gapped Wallets

Wallets installed on a device that never connects to the internet, like an old phone or computer.Very secure but requires technical know-how.

• Paper Wallets

A physical piece of paper with your public/private keys or QR codes.Very risky if not stored safely. Obsolete for most users.

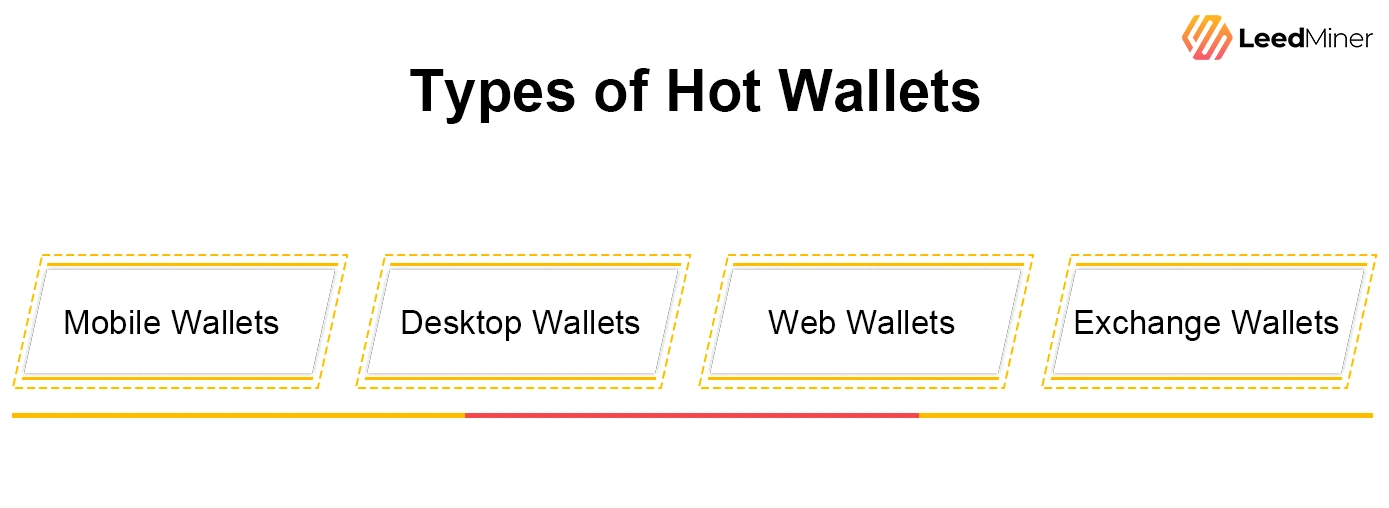

Types of Hot Wallets

• Mobile Wallets

Apps like Trust Wallet, Exodus, or Atomic Wallet. Easy to use on smartphones.Great for everyday use, but be careful of malware or theft.

• Desktop Wallets

Programs like Electrum or Bitcoin Core installed on your PC or Mac.Good control; semi-secure depending on internet exposure.

• Web Wallets

Browser-based wallets like MetaMask or exchange-integrated wallets.Convenient, but always connected to the web.

• Exchange Wallets

Wallets hosted by exchanges like Binance, Coinbase, or OKX if you sell mined coins immediately.Risk: You don’t control the private key.

Choosing the Right Wallet for Mining

How you mine—and what you do with your earnings—should determine your wallet type:

Scenario A: You Mine and Hold Long-Term

Use a cold wallet. Best options:

- Hardware wallet (Ledger, Trezor)

- Air-gapped mobile/desktop wallet

This setup minimizes online exposure and protects your mining profits.

Scenario B: You Mine and Sell Frequently

Use a hot wallet, especially:

- Mobile wallet with fast access

- Exchange wallet (e.g. Binance, Coinbase)

This gives you instant access to trade or convert your crypto into fiat.

For All Miners:

- Always configure your mining pool with the correct wallet address.

- For merged mining, set wallets for both coins (e.g. LTC and DOGE).

- Double-check wallet addresses—typos or wrong addresses = lost rewards.

Protect Your Wallet Like Your Life Depends on It

Losing access to your wallet means losing your coins forever.There’s no “forgot password” button in crypto.

Must-do Security Practices:

- Back up your seed phrase in multiple secure places.

- Never share your private key or recovery phrase.

- Consider encrypting your wallet or using multi-signature setups.

- Don’t store wallet data on cloud drives or online notes.

CONCLUSION

Choosing the right wallet isn’t just about tech or convenience—it’s about protecting your hard-earned crypto. Especially if you’re a miner, your wallet is the gateway between your computational power and your earnings.Set it up wisely, secure it tightly, and never lose your keys. Remember: No Key = No Coin.