SUMMARY

The Goldshell E-AE1M, released in April 2025, is a mid-range ALEO miner offering 230 MH/s of hashrate with 2000W power consumption. While it doesn’t lead the pack in raw performance or efficiency, its lower price point and stable daily returns make it an attractive option for budget-conscious miners. In this article, we’ll explore how the E-AE1M compares with other popular ALEO miners in terms of profitability, power efficiency, and long-term value. From net income calculations to positioning in the current market, we break down what makes the E-AE1M a smart choice for miners looking to balance cost and return.

Technical Specifications

| Manufacturer | Goldshell |

|---|---|

| Model | E-AE1M |

| Also known as | Goldshell Echo E-AE1M 3U Rack Miner |

| Release | Apr 2025 |

| Size | 443 x 360 x 135mm |

| Weight | 15.15kg |

| Noise level | 45dB |

| Cooling | Air |

| Fan(s) | 2 |

| Power | 2000W |

| Rack format | 3U |

| Interface | Ethernet / WiFi |

| Temperature | 5 – 35 °C |

| Humidity | 5 – 65 % |

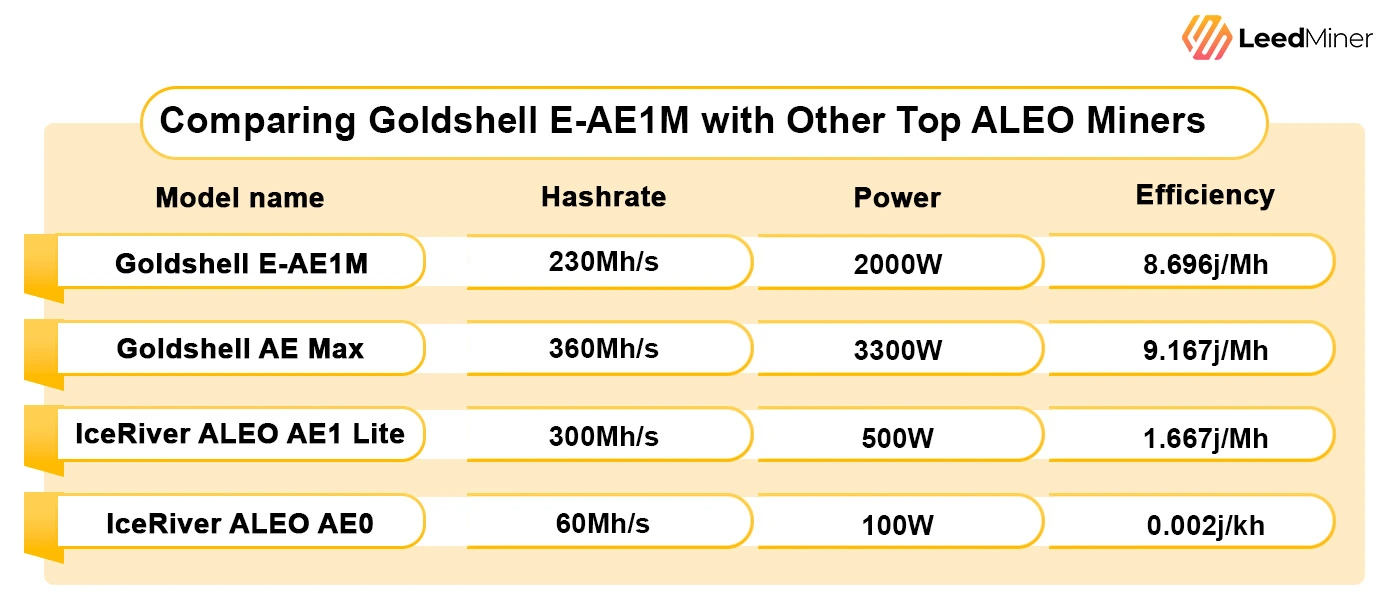

Comparing Goldshell E-AE1M with Other Top ALEO Miners

As the demand for ALEO mining continues to rise, several manufacturers have released high-performance miners tailored to various needs. Let’s take a closer look at how the Goldshell E-AE1M, which launched in April 2025, compares to other top ALEO miners in terms of hashrate, power consumption, and efficiency.

Goldshell E-AE1M: A Balanced Mid-Range Option

The Goldshell E-AE1M

Goldshell AE Max: The High-Performance Contender

The Goldshell AE Max

IceRiver ALEO AE1 Lite: The Efficiency Leader

On the opposite end of the spectrum, the IceRiver ALEO AE1 Lite

IceRiver ALEO AE0: Entry-Level with Low Power Usage

The IceRiver ALEO AE0

Conclusion: Optimizing for Your Mining Strategy

From the perspective of Goldshell E-AE1M, it holds a strong position as a mid-range miner that balances performance with manageable power consumption. It doesn’t offer the extreme performance of the AE Max or the ultra-efficiency of the AE1 Lite and AE0, but its stable hashrate and energy usage make it a versatile option for many miners.

- If you need maximum performance and fast ROI, the AE Max may be your choice, but be prepared for higher energy consumption.

- If energy efficiency is your priority, the AE1 Lite and AE0 are unbeatable, with the AE1 Lite offering a better balance between performance and power.

Each miner fits different needs — whether you’re scaling your operation, saving energy, or just starting your mining journey.

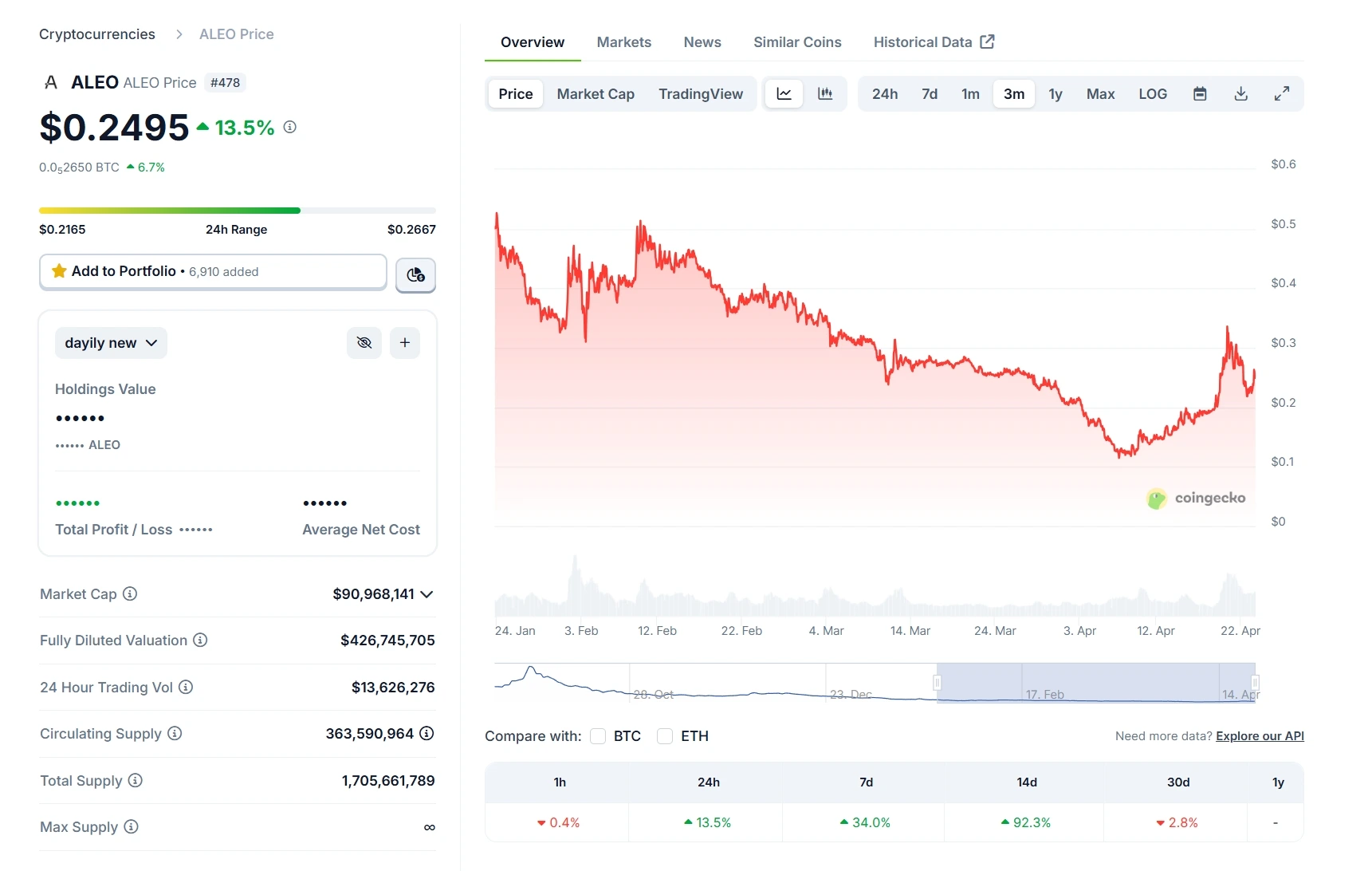

ALEO Coin Prices History

Let’s take a look at the current market status of ALEO

ALEO Market Snapshot (As of April 23, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.2533 |

| All-Time High (ATH) / Low (ATL) | $6.72 / $0.1129 |

| Market Capitalization | $91,999,177 |

| Fully Diluted Valuation (FDV) | $431,582,455 |

| Market Rank | #473 |

| Circulating Supply | 363,590,964 |

ALEO Price Trend

The ALEO (ALEO) token has recently demonstrated a notable uptick in market activity and price performance. Over the past 24 hours, ALEO recorded a trading volume of $13.39 million, reflecting a 9.00% increase from the previous day — a sign of growing investor interest and liquidity in the market. Currently, ALEO is priced 96.22% below its all-time high of $6.72, yet it has climbed 124.62% above its all-time low of $0.1129, indicating a significant rebound from previous lows and potential recovery momentum. The market capitalization stands at approximately $91.99 million, ranking it #473 on CoinGecko, with a circulating supply of 360 million tokens. Meanwhile, the fully diluted valuation (FDV) is estimated at $431.58 million, assuming the full supply of 1.7 billion tokens comes into circulation. In terms of weekly performance, ALEO has seen a 35.70% price increase, substantially outperforming the global crypto market average of 10.40%, and even surpassing the 12.50% rise among other Smart Contract Platform tokens. This strong relative performance suggests increasing confidence in the ALEO ecosystem and its long-term potential. 📌 All data as of April 23, 2025. For real-time updates, please refer to CoinGecko or other reliable sources.

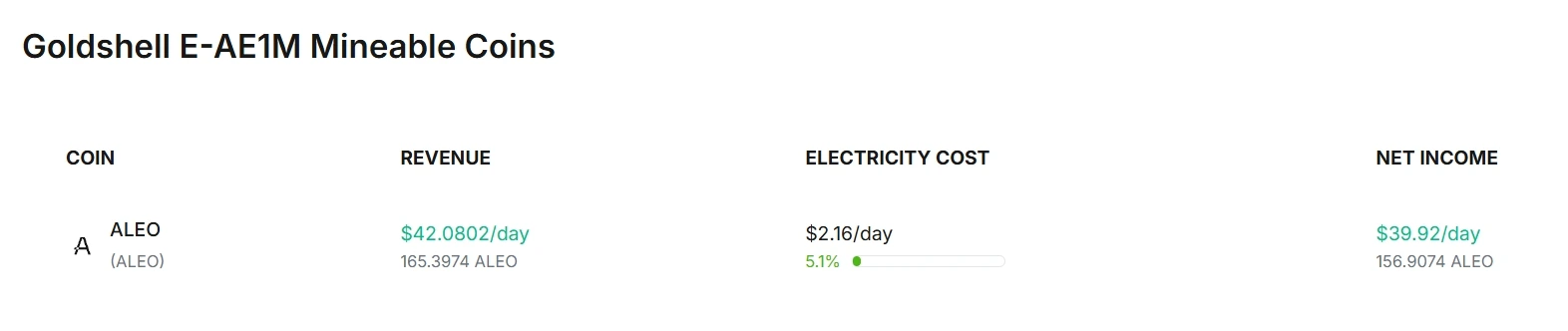

Goldshell E-AE1M Profitability

With a power consumption of 2000W and an electricity rate of $0.045/kWh, Goldshell E-AE1M delivers a strong daily profitability

- Daily Revenue: $42.08 (165.40 ALEO)

- Electricity Cost: $2.16/day

- Net Income: $39.92/day (156.91 ALEO)

- Power Efficiency: Only 5.1% of the revenue is spent on electricity

This highlights the balanced performance and cost efficiency of the Goldshell E-AE1M. Despite not being the most powerful miner, its controlled power draw and solid output allow miners to retain nearly 95% of daily earnings as profit. For medium-scale ALEO miners looking for stability and dependable returns, the E-AE1M stands out as a highly competitive choice.

Future Perspective of Goldshell E-AE1M

While the Goldshell E-AE1M may not top the charts in terms of hashrate, power consumption, or efficiency, it strategically positions itself in the second tier of ALEO miners — and that’s precisely where its long-term value lies. Compared to high-performance ALEO miners like the AE Max or IceRiver AE1 Lite, the E-AE1M comes with significantly lower upfront costs. This makes it a practical choice for miners with limited budgets who are still looking to enter the ALEO space with a viable return on investment. Its moderate specs also help maintain a manageable electricity footprint, enabling faster ROI cycles especially in regions with affordable power. For miners focused on capital efficiency, the E-AE1M offers a balanced blend of affordability, performance, and brand reliability. As ALEO mining becomes more competitive, devices like the E-AE1M will continue to appeal to those seeking cost-effective entry points and steady daily income without the heavy financial burden of top-tier hardware.